St. Louis, Mo., May 6, 2023 / 04:00 am (CNA).

When “The Bible in a Year” podcast hosted by Father Mike Schmitz shot to the top of the charts at the start of 2021, it inspired millions of people to dive more deeply into the Bible. One Michigan third grader was not content to merely listen, though — he wants to be a podcasting priest like Schmitz when he grows up. And he’s well on his way to making that dream a reality.

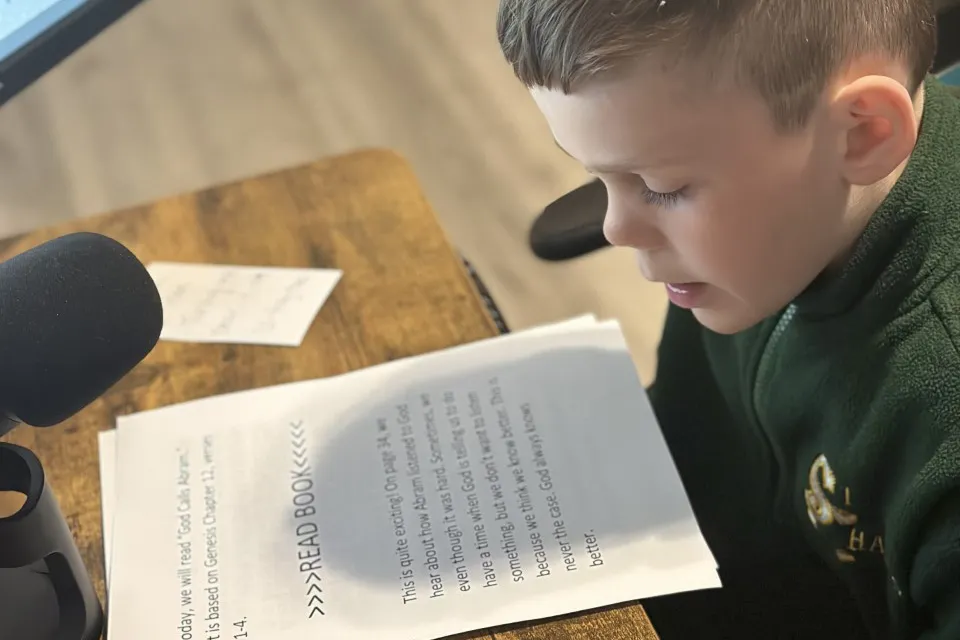

Teddy Howell, 9, is the creator — with the help of his parents, Stephani and Sean — of the “Kid’s Bible in a Year with Teddy” podcast, which launched on March 12. In each episode, released Sundays and Wednesdays, Teddy leads a prayer and then reads a passage from the Great Adventure Kids Catholic Bible Chronicles, a book from publisher Ascension that provides 70 Bible stories arranged in the same timeline order that the “Bible in a Year” podcast uses.

Teddy’s mom Stephani said her son, the oldest of six siblings, already loves learning about and sharing his Catholic faith with others. She said he often stays up at night reading the Bible under the covers with a headlamp and recently started serving at the altar at the family’s parish in southeast Michigan.

“He’s always had a love for the Church and the priesthood. Kind of of his own accord, he decided he wanted to go to daily Mass over the summer,” she said.

When asked directly what he wants to be when he grows up, Teddy didn’t hesitate — he wants to be a priest. He said his favorite part of the Mass is the Liturgy of Eucharist, though given his love for the Bible, the Liturgy of the Word also touches him deeply. He said his favorite parts of the Bible are the Gospel passages about the crucifixion and resurrection of Jesus.

Teddy’s podcasting ambitions were sparked almost wholly by the example of Schmitz, the popular Minnesota priest who, in his podcast, reads through the entire Bible in 365 daily episodes, plus a prayer and reflection. Teddy’s parents would often put on “The Bible in a Year” for the family in the car, but turned it off if Schmitz issued any warnings about material unsuitable for children, as he occasionally does throughout the series. The interruptions perturbed Teddy, who craved a Bible podcast he could listen to in its entirety.

It was this desire, along with the prayers offered by Schmitz at the end of each “Bible in a Year” episode, that really inspired Teddy to want to create his own podcast.

He told his parents he wanted to give it a try, reading the Kids Catholic Bible Chronicles aloud. Stephani contacted the publisher of the book, Ascension, to see if they’d be willing to allow him to read the words from the book on-air. Ascension agreed (although Teddy always reads a disclaimer noting that Ascension doesn’t endorse or review the episodes).

Teddy begins each episode with a self-written prayer, then reads a passage from the book related to a Bible story, and then offers a reflection. He writes the scripts himself on his parents’ computer and then does the recording, editing, and posting of the episodes with their help. Teddy uses a microphone attached to his parents’ computer to get the job done.

The technical aspects of creating the podcast have been a learning experience for Teddy’s parents as well. Sean said he asked around among his friends about how to start a podcast, and his friends recommended the online platform Anchor, which allows listeners to subscribe and listen on just about any podcast app.

As of early May, Teddy has posted a dozen episodes, with no plans to slow down. His podcast has already garnered several thousand listens across several countries, with a growing number of five-star ratings. Ascension has even taken notice, sharing episodes from Teddy’s podcast on social media.

Beyond being a great learning experience for the budding young priest, Teddy has genuine hopes that his podcast will touch people’s lives.

“Hopefully a lot more people who are not Christian will become Christian by the end of this year by listening to my podcast,” he said.

If you value the news and views Catholic World Report provides, please consider donating to support our efforts. Your contribution will help us continue to make CWR available to all readers worldwide for free, without a subscription. Thank you for your generosity!

Click here for more information on donating to CWR. Click here to sign up for our newsletter.

Leave a Reply